OPTION A: SECTION 179 IS FOR ANY AG BUSINESS OWNER

If you’re a farmer, rancher or business owner who is actively marketing and selling their wares (like beef from livestock, vegetable boxes from your fields) then according to the IRS you qualify for tax deductions for agricultural farm equipment that you purchase during the fiscal year. Any RPS solar pump, whether a submersible or surface pump, falls into the category of agricultural farm equipment. All of the system component costs are covered including the pump itself, solar panels, controller and any associated plumbing, solar panel mounting, batteries and wiring needed for the installation.

IRS SECTION 279 – DEPRECIATING PROPERTY

According to the IRS, “anyone buying, financing or leasing new or used equipment for the tax year will qualify for a Section 179 deduction, provided the total amount is less than $3,620,000″.

2024 is a special year, as Section 179 has been updated to allow 100% UP FRONT DEDUCTIONS from your tax bill. According to Section179.org “That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income”. If you purchase a solar pump for $2,000, you can write off the entire $2,000 this year!

In previous years, farm equipment would be required to depreciate over time. Under depreciation, your deductions are scheduled out over multiple years and the dollar amount is capped -for example, you might have been limited to only claiming 20% of the $2,000 solar pump cost over a 5 year period, so $400 in deductions in Tax Year 1, another $400 in Tax Year 2, and so on.

Please consult with your personal tax professional for guidance on Section 179.

OPTION B: TAKE ADVANTAGE OF NEW INFLATION REDUCTION ACT TAX CREDIT

Option B is for business owners, regular consumers and homeowners. In late 2022, the Inflation Reduction Act extended benefits from the Business Energy Investment Tax Credit, as well as added some new tax credits. Tax benefits are extended through 2032, meaning any solar pump project could enjoy a 30% tax benefit on installed solar and battery storage equipment. The Inflation Reduction Act laid out that any solar system, whether connected to the grid or operating off-grid, is applicable to receive a 30% credit on taxes for the purchase price of the components, as long as that system is providing power for a “dwelling unit”. RPS interprets this as, if there’s a solar system providing power for a homes water pump (or potentially other appliances in the case of Watersecure), its providing power for the dwelling unit. As always, consult your personal tax professional, but we think it’s a pretty clear case of eligibility. There is no maximum credit, write off as much as you want! The tricky part here is that only some components are eligible, including…

- Solar PV panels, inverters, racking, balance-of-system equipment, and sales and use taxes on the equipment;

- CSP equipment necessary to generate electricity, heat or cool a structure, or to provide solar process heat;

- Installation costs and certain prorated indirect costs;

- Step-up transformers, circuit breakers, and surge arrestors;

- Energy storage devices that have a capacity rating of 5 kilowatt hours or greater (even if not charged with solar)[9]

- For projects 5 MW or less, the tax basis can include the interconnection property costs spent by the project owner to enable distribution and transmission of the electricity produced or stored by the system—this can include costs that are incurred beyond the point at which the energy property interconnects to the distribution or transmission systems

While Section 179 write offs apply to solar pump or solar power installations anywhere on the ranch or farm, the Inflation Reduction Act language requires the system to provide power to a “dwelling unit”. Any “dwelling unit” qualifies for the tax credit, including mobile homes, boats, homes, off-grid cabin or RVs. Your RV or off grid cabin must be accepted by the IRS as a second home for tax purposes to be valid for the credit.

Let’s look at the official language for what type of systems exactly qualify….

1) Standalone (off-grid) PV systems installed after 12/31/2022 with at least 3kWh of storage capacity will be covered by the Solar ITC at 30%.

2) Hybrid (grid-tied but also connected to battery storage) PV systems installed after 12/31/2022 are covered by the Solar ITC at 30% so long as these additional criteria are met:

- The PV and batteries were installed at the same time

- The storage capacity of the battery bank is at least 3kWh

3) For grid-tied systems installed before 12/31/2021 that had battery storage added to them during 2022, the battery storage components likely qualify for the 30% rate.

4) Standalone and Integrated Battery Storage. Any battery bank used for a “dwelling unit” is eligible for a tax credit, even if that batteries aren’t connected or charge by solar panels. Before the Inflation Reduction Act was passed, batteries had to be connected to a solar panel system in order to qualify for the federal solar tax credit. (You can claim the tax credit for batteries even if you buy and install them a year or more after you install the solar system.)

Eligible battery storage still must must store at least 3 kWh! Straight from the Inflation Reduction Act language…

“(2) DEFINITION OF QUALIFIED BATTERY STORAGE TECHNOLOGY EXPENDITURE.—Paragraph (6) of section 25D(d) is amended to read as follows: ‘‘(6) QUALIFIED BATTERY STORAGE TECHNOLOGY EXPENDITURE.—The term ‘qualified battery storage technology expenditure’ means an expenditure for battery storage technology which— ‘‘(A) is installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer, and ‘‘(B) has a capacity of not less than 3 kilowatt hours.”

WHICH RPS SYSTEMS QUALIFY FOR THE INFLATION REDUCTION ACT 30% TAX CREDIT?

Eligible Solar Pumps

If you are planning on using an RPS Solar Pump for a “dwelling unit”, then any of our solar pump kits quality. However, the pump itself is not a valid write off. If you contact the RPS team we can get you a custom write up of what components are eligible and how much you could expect to write off for those eligible components. For example, from an RPS 400 pump kit you could expect to write off…

- Four solar panels

- RPS Universal controller

- wiring

Call our office at 888-637-4493 to talk with a team member

If you want to source other components from us to easily set up the RPS 400 kit, you could also write off…

Eligible Watersecure Kits

All of the Watersecure 3K, Watersecure 6K and Watersecure 12K kits are eligible for the 30% tax credit. All components are covered as well! The only rule you’ll have to abide by is the 3kWh battery bank storage capacity. RPS carries two kinds of batteries, 55 Ah and 160 Ah. To meet the 3 kWh requirement, you’ll need at least the Watersecure 3K-1200 system, which comes with eight 55 Ah batteries. Any of the Watersecure systems using 160 Ah batteries will also automatically meet the 3kWh minimum. All eligible Watersecure systems are listed below…

- Watersecure 3k-1200

- Watersecure 3k-1800

- Watersecure 6k-800

- Watersecure 6k-1200

- Watersecure 6k-1800

- Watersecure 6k-2400

- Watersecure 12k-1600

- Watersecure 12k-2400

Eligible Sun TiTan Solar Trailer

The Sun Titan Solar Trailers are eligible for the 30% tax credit. All components are covered as well! All Sun Titan Battery Banks meet the 3 kWh requirement.

HOW DO I EXPENSE AN RPS SOLAR PUMP OR WATERSECURE KIT?

- Confirm you qualify for the 30% tax credit

- Collect receipts from your purchase (RPS can provide receipts and any other paperwork you require)

- Complete IRS 5965

- Add the credit to Form 1040

Important! RPS is a solar water pump company dedicated to saving you fistfuls of cash, but we are not tax specialists! Every rancher, farmer, off-gridder and homeowner will have different tax circumstances. Please consult with your dedicated tax professional to confirm eligibility write offs.

To take advantage of 2024 tax deductions you’ll need to purchase a solar pump by December 31, 2024. Our end of year can get pretty busy, if haven’t already, we suggest calling in and speaking to one of our solar pump specialists to get the planning process started. No one is on commission, we just want to get you the right solar pump for your property and save you some money! Call an RPS team member at 888-637-4493

Take your water needs into your own hands with our help!

Find The Right System For You!

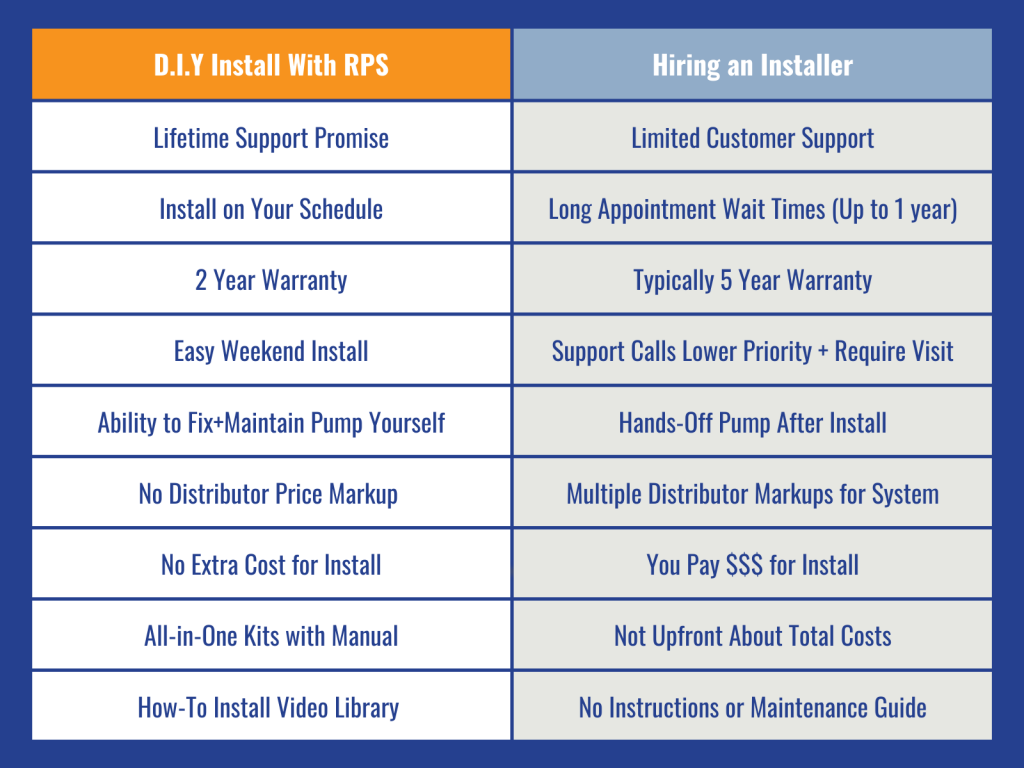

WHAT ARE THE BENEFITS OF A D.I.Y. INSTALL WITH RPS?

These Folks Did It Themselves and You Can Too!

“The support from RPS is the very best in the business. We are so glad we chose RPS for our off grid farm. Thanks!”

– Dave, CA

“I don’t know how to thank you, I am a home builder in Jasper, Texas. I believe in proposes made, promises kept. My order was delivered on Thursday and was short the half turnkey, but you guys went the extra mile to get it to me overnight. I made my 10 hour trip , and installed this morning, back in time not to affect my schedule. You guys are just the greatest, and installed in 4 hours …. If all companies were like this! I give you 10 stars and thank you again for the great service, I will use on every well in the future, thanks again”

– Jim, Owner of Shabar Homes, TX

“We have two wells using 100% solar power to bring water up from 110 feet deep wells to irrigate 4 cultivated acres of fruit and nut orchard crops and it is the BEST THING EVER!!! Free flowing water during the day into our tanks that then send water to our crops in a drip irrigation system (also using this company’s Tankless Pressure Pump). I waited several months to leave this review and now I am a raging fan. Thanks to RPS we can operate completely off-grid to grow food in a regenerative sustainable way. Farm is in Oregon on Instagram at The Farm Up Lost Creek.”